“China holds a globally leading position in the field of large cargo drones. We have signed procurement agreements for 20 sets of the HY100 large UAV system,” said Agung Sasonkojati, CEO of Indonesia’s PT Drone Transport.

As the world’s largest archipelago, Indonesia has long struggled with delivering goods to its remote islands. Agricultural and fishery products often spoil before reaching markets, while emergency medical supplies are delayed due to weak infrastructure. Today, Chinese-made drones are providing new solutions to these long-standing challenges, opening a new chapter in global UAV logistics.

China’s Export Growth and Global Market Share

China has become the dominant force in global UAV exports. Between January and November 2024, Chinese drone exports reached USD 1.944 billion, up 16.8% year-on-year, with shipment volumes rising 24.2% to 3.25 million units. This strong momentum carried into the first half of 2025, when total UAV trade climbed 37.1% year-on-year to USD 1.359 billion.

Exports contributed USD 1.280 billion, while imports rose sharply to USD 79.2 million, leaving a surplus of USD 1.201 billion. Today, Chinese drones account for over 70% of global sales, cementing China’s role as the world’s largest producer and exporter of UAVs.

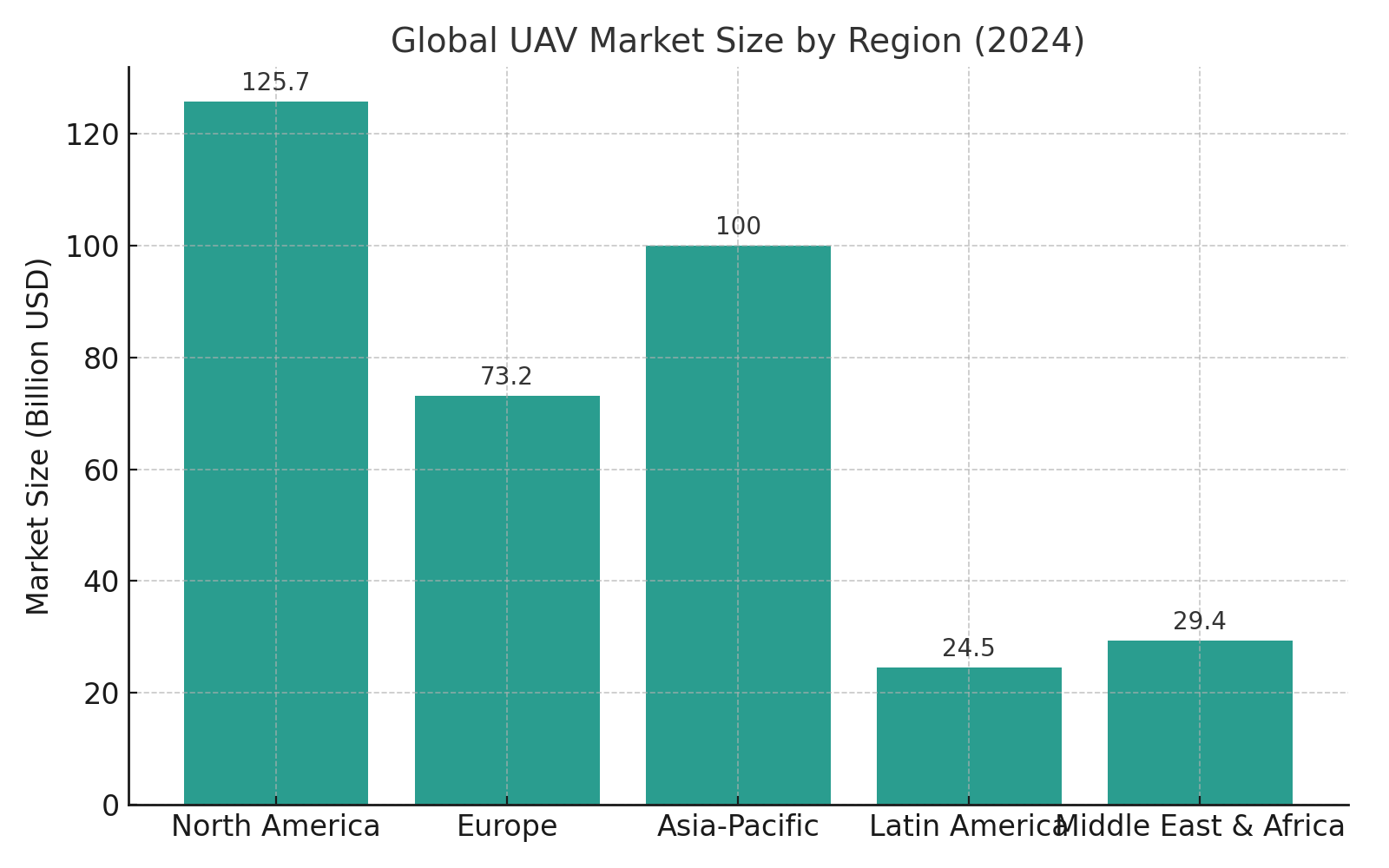

Figure 1. Regional Distribution of the Global UAV Market (2024)

From Consumer Models to Heavy-Duty Platforms

The structure of China’s exports reflects a maturing industry. Remote-controlled UAVs remain the backbone, accounting for 96.3% of exports in early 2025. However, growth is shifting toward large-scale industrial platforms.

The HY100 cargo UAV illustrates this transition: with a maximum take-off weight of 5.25 tons, a payload capacity of 1.9 tons, and a range of 1,800 km, it is capable of both high-altitude cruising and ultra-low-level operations. Similarly, the Caihong-4 (CH-4) became the first large civilian UAV in China to receive a special airworthiness certificate, proving that Chinese platforms meet rigorous aviation standards. The KF-150 heavy-lift UAV, with its 150 kg payload, is already being deployed in logistics, agriculture, and emergency response worldwide.

Industry Leaders and International Expansion

Behind these platforms is a robust supply chain. Tianyu Hangtong has specialized in the HY100, winning over RMB 1 billion (USD 140M) in overseas orders in 2025. CASC Rainbow UAV, part of China Aerospace Science and Technology Corporation, dominates military exports with its CH-series, which account for 70% of China’s drone sales abroad. Meanwhile, Zongheng UAV has pioneered vertical take-off fixed-wing drones, offering integrated hardware-software solutions now deployed in more than 40 countries.

These companies are not only competitive at home but also abroad, offering performance at a fraction of the cost of Western equivalents. This cost-performance balance is a key reason behind China’s dominant global market share.

Export Models: From Selling Hardware to Delivering Solutions

China’s drone exports are no longer limited to hardware. Increasingly, they include comprehensive solutions.

Contracts for the HY100 signed with Indonesia and Kazakhstan, for example, cover not only the aircraft themselves but also training, maintenance, and long-term operational support. Buyers are not just purchasing drones, but entire modern logistics frameworks built around UAV technology.

This evolution marks China’s shift from exporting products to exporting systems and standards. It is a critical step as Chinese firms begin shaping international regulations and operational benchmarks in the low-altitude economy.

Regional Markets and Belt and Road Growth

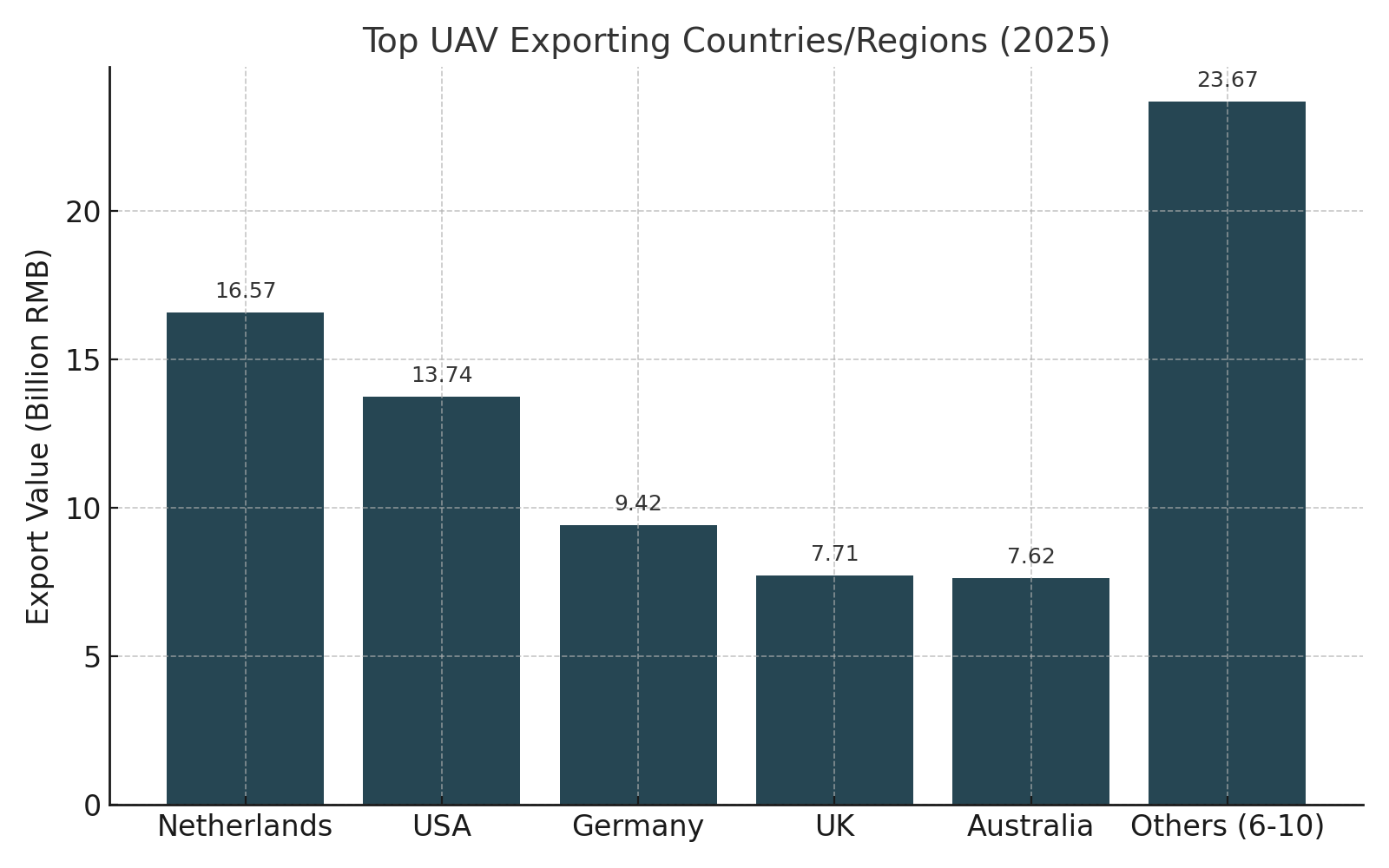

In early 2025, China’s top UAV export destinations were Hong Kong, the Netherlands, and the United States, with export values of USD 167.4 million, USD 145.9 million, and USD 108.1 million respectively. Hong Kong’s exports surged 858.5%, underscoring its importance as a global re-export hub.

Meanwhile, Belt and Road Initiative (BRI) countries are emerging as new growth centers. CASC Rainbow has already exported drones to more than 10 BRI nations, including Saudi Arabia, Algeria, and Pakistan. Tianyu Hangtong’s partnerships in Indonesia and Kazakhstan demonstrate China’s deepening role in Southeast Asia and Central Asia.

Figure 2. Leading UAV Exporting Countries and Regions (2025)

Policy and Regulatory Headwinds

Despite this success, export controls have become a defining factor in China’s UAV trade. In recent years, the Chinese government has expanded regulations covering drones and aerospace-related technologies. Certain UAV types, engines, avionics, and imaging systems are now subject to export licensing requirements.

For buyers, this can mean longer lead times, stricter documentation, and higher costs. For Chinese exporters, it means investing heavily in compliance and adjusting sales strategies. Temporary restrictions introduced in 2023 also disrupted certain consumer drone exports, though adjustments in 2024 eased some of these measures.

Airmobi has published detailed announcements on these changes, such as the temporary export control of certain UAVs and the expanded controls covering aerospace and engine manufacturing technologies. These policies illustrate how government oversight is now an inseparable part of China’s drone export story.

Turkey’s Rise as a Global Competitor

While China dominates in scale, Turkey has rapidly emerged as a major competitor. Baykar, Turkey’s leading UAV manufacturer, now controls around 65% of the global UAV export market, with Baykar itself accounting for 60% of that share. More than 90% of its revenue comes from exports, and its TB2 and TB3 drones have been widely adopted due to their combat-proven performance and relatively affordable price.

As outlined in previous article How Turkey Captured 65% of the Global Drone Export Market — And What It Means for China, Turkey’s success lies in its combination of advanced R&D, supportive export policies, and strategic alignment with customer demand in emerging markets. For China, Turkey’s rapid ascent underscores the need to strengthen its competitive edge not just through price, but also through technology, services, and compliance.

Looking Ahead: Trends in the Low-Altitude Economy

The future of China’s UAV exports is closely tied to the rise of the low-altitude economy, which reached RMB 506 billion in 2023 (+34% year-on-year) and is projected to surpass RMB 1 trillion by 2026.

Applications are multiplying, from agriculture and logistics to disaster response and environmental monitoring. The HY100 has already conducted 6,300+ safe missions, proving its versatility and reliability. On the innovation front, China continues to lead globally in patents, with advanced models such as the CH-7 stealth UAV expected to roll out by late 2025.

Meanwhile, industrial clusters like Shenzhen are building “super hubs” for global expansion, hosting weekly programs that help UAV companies scale internationally.

Conclusion: From Products to Global Standards

China’s UAV industry is evolving rapidly. It is no longer just about producing affordable drones; it is about building global brands, exporting integrated solutions, and setting international standards.

At the same time, challenges remain — from export controls and compliance to growing competition from Turkey and other players. Navigating these challenges will require stronger service networks, investment in R&D, and proactive engagement in global regulation.

For international buyers, platforms like Airmobi bridge the gap between advanced Chinese drone manufacturing and real-world applications. From the Skyeye fixed-wing UAVs to the V-series VTOL platforms, Airmobi delivers cost-effective, long-endurance drones that are already transforming industries across the world.